Macro Trends in Financial Services

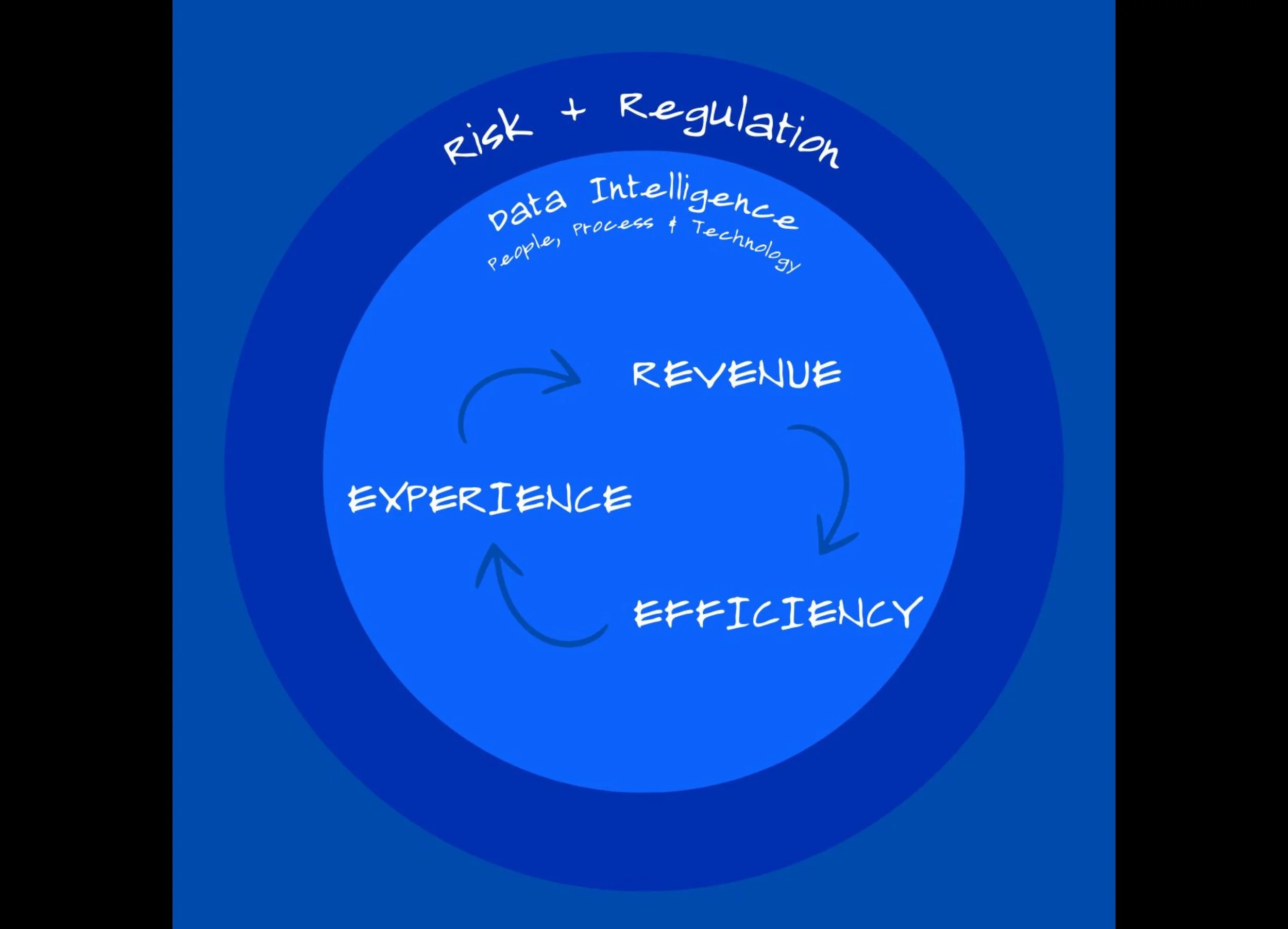

I meet with about 10 Financial Services organizations weekly to help them address their most significant challenges and opportunities. As my simplistic diagram implies, I consistently hear three challenges/opportunities and two overlaying considerations. The companies that actively address these five themes thrive.

REVENUE, EFFICIENCY, & EXPERIENCE

Every organization tries to increase revenue, create efficiency, and cultivate a differentiated customer experience. Although their challenges and opportunities may go by other names, their stated needs fall into these categories when distilled.

To address REVENUE, we might discuss their sales and marketing strategies, accounting processes that slow receivables and risk cashflow, leveraging their data as a new or enhanced revenue stream, or the need for a unified and aligned executive leadership team.

When EFFICIENCY is their challenge, we can talk about cost optimization throughout their M&A process, inefficiencies in their cloud ecosystem that create unnecessary FinOps spend and unleashing their workforce through automation and new AI tools.

When their customer EXPERIENCE is impeding growth, we often discuss how to maximize and modernize their CRM platform, using AI and ML to transform contact center processes and create a differentiated and integrated experience across all channels.

As important as these three challenges are, they are only adequately addressed when considered within the broader Data Intelligence and Risk/Regulation ecosystem.

2 OVERLAYING CONSIDERATIONS

DATA INTELLIGENCE is the people, processes, and technology that comprise your data ecosystem, encompassing how you store, evaluate, and apply your data. In the age of AI, consistent data breaches, and the need to respond to market changes at a hyper-speed, your Data Intelligence is EVERYTHING! Building a Modern Culture of Data (MCoD) will determine your organization's long-term success.

The broadest overlay is RISK + REGULATION. We find that 60-70% of discretionary spend for our FS clients is aligned to Risk/Reg. They also acknowledge that the fastest—and often ONLY—way to get funding is by showing the quantitative R/R value of their project. Whether a bank considering new capital requirements, a FinServ SaaS company mitigating data breach risk, or an insurance company evaluating the actuarial impact of more natural disasters, every decision you make as an organization passes through the overlayed filter of Risk and Regulation.

My role in these conversations is to actively listen, ask strategic questions, and help prioritize the solutions most critical to short and long-term success. Regardless of the external or internal forces you’re facing in your FS work, addressing these 5 themes can make all the difference in what you are able to accomplish, both individually and organizationally.